Is your paycheck about to take a hit? The Budget 2024-25 has proposed a significant change that could impact millions in Pakistan. Salaried individuals may face up to 35% income tax. This raises a lot of questions and concerns. What does this mean for your monthly budget? How will this affect your savings and investments?

This post aims to break down the new tax brackets and what they could mean for your financial future. We’ll explore the government’s motivation behind these changes and provide insights on how to navigate this new landscape. Whether you’re an entry-level employee or a seasoned professional, understanding these tax shifts is crucial. Stay with us as we unpack the details and offer practical advice for managing your finances in light of these changes.

Overview of Budget 2024-25

The Budget 2024-25 is packed with substantial financial changes and goals. From new tax rates to funding allocations, this budget aims to steer Pakistan’s economy in a specific direction. Let’s break down the main features, focusing on key financial allocations and the government’s economic goals.

Key Financial Allocations

This year’s budget has earmarked significant funds for various sectors. Here are the main areas receiving top financial priority:

- Healthcare: A large chunk of the budget is dedicated to boosting healthcare. This includes new hospitals, medical research facilities, and upgrading existing healthcare infrastructure.

- Education: Funding for education has seen a notable increase. The budget includes provisions for building new schools, hiring more teachers, and improving educational materials.

- Infrastructure: Major projects include the construction of highways, bridges, and urban transit systems. This aims to improve connectivity and support economic growth.

- Defense: There’s a considerable allocation for defense to ensure national security and modernize the armed forces.

- Social Welfare: Programs focused on poverty alleviation and support for the underprivileged sectors are receiving increased funding.

These allocations reflect the government’s focus on improving public services and essential infrastructure, laying the groundwork for long-term economic stability.

Economic Goals and Priorities

The budget isn’t just about numbers; it outlines specific economic targets and priorities for the upcoming fiscal year. Here are the main objectives:

- Economic Growth: One of the key priorities is to stimulate GDP growth. This involves strategies to boost industrial production, agriculture, and services.

- Job Creation: The government aims to reduce unemployment rates through various public and private sector initiatives. This includes skill development programs and encouraging entrepreneurship.

- Inflation Control: Keeping inflation in check is crucial. Measures to stabilize prices for essential goods and services are part of the plan.

- Tax Reforms: The introduction of new tax brackets, including the proposed 35% income tax for the salaried class, aims to increase revenue and balance the budget.

- Sustainable Development: There is a clear focus on sustainable practices, including investments in green energy and environmentally friendly projects.

By setting these goals, the government aims to create a balanced and sustainable economic landscape that can withstand future challenges.

Income Tax Changes for Salaried Class

If you’re among Pakistan’s salaried employees, brace yourself for significant changes in your income tax. The Budget 2024-25 introduces new tax rates that could take a larger bite out of your paycheck. This section covers the nitty-gritty details of these changes.

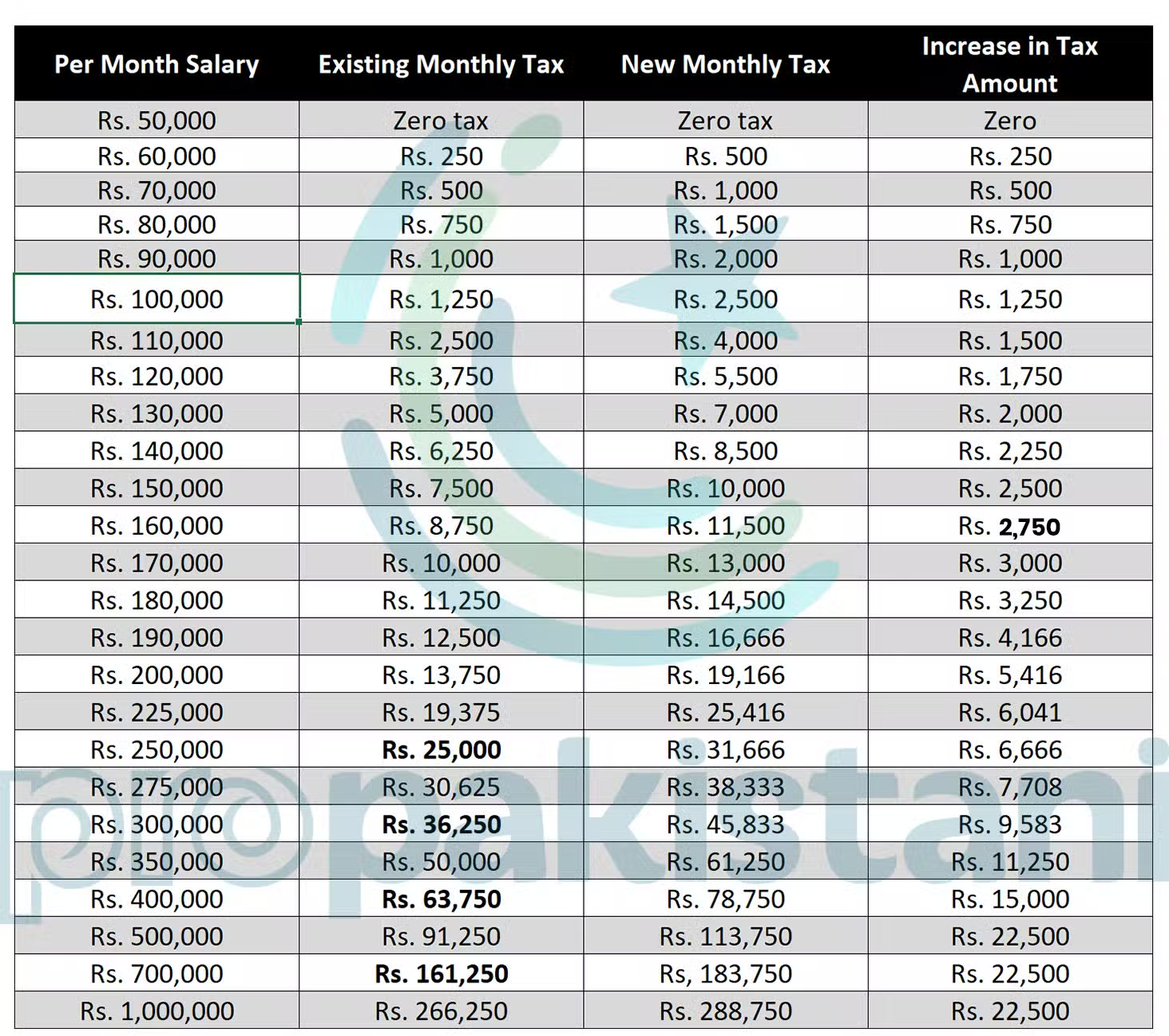

New Tax Rates and Brackets

Understanding the new tax rates is crucial for financial planning. Let’s break down the new income tax brackets for salaried individuals. Here are the proposed rates:

- Income up to PKR 600,000: 0%

- Income from PKR 600,001 to PKR 1,200,000: 5%

- Income from PKR 1,200,001 to PKR 2,400,000: 10%

- Income from PKR 2,400,001 to PKR 3,000,000: 15%

- Income from PKR 3,000,001 to PKR 5,000,000: 25%

- Income above PKR 5,000,000: 35%

These new brackets indicate that higher earners will face steeper rates. The aim is to make the tax system more progressive, ensuring those with higher incomes contribute more.

Comparison with Previous Tax Rates

How do these new rates stack up against last year’s? Let’s take a look:

- Previous Income up to PKR 600,000: 0%

- Previous Income from PKR 600,001 to PKR 1,200,000: 2%

- Previous Income from PKR 1,200,001 to PKR 2,400,000: 7%

- Previous Income from PKR 2,400,001 to PKR 3,000,000: 10%

- Previous Income from PKR 3,000,001 to PKR 5,000,000: 20%

- Previous Income above PKR 5,000,000: 30%

As you can see, the new rates are higher across most brackets. For instance, someone earning PKR 3,500,000 will now pay 25%, up from 20%. This means more of your income will go to taxes, which could affect your disposable income and savings.

Rationale Behind the Tax Increase

Why is the government hiking income tax rates? Several reasons justify this move:

- Revenue Generation: The government aims to boost revenue to fund public services like healthcare, education, and infrastructure. Higher taxes from the salaried class are expected to fill the budget gaps.

- Economic Stability: Increasing taxes on higher earners can help balance the budget and reduce national debt. This financial stability is crucial for long-term economic health.

- Equity: By taxing higher incomes more, the government seeks to create a fairer tax system. The idea is that those who can afford to pay more should contribute a larger share.

In summary, these changes are designed to increase state revenue and create a more equitable tax structure. While the higher rates may pinch your wallet, they serve broader economic goals that aim to benefit society as a whole.

Stay tuned as we continue to explore other aspects of the Budget 2024-25. Understanding these changes now will help you navigate your financial future more effectively.

Impact on Salaried Individuals

The new tax rates introduced in the Budget 2024-25 will have significant implications for salaried individuals across Pakistan. Below, we explore how different income levels will be affected and offer tips for financial planning to mitigate the impact.

Financial Burden on Different Income Levels

The proposed tax brackets mean different things for different income levels. Let’s break it down:

- Low-Income Earners: Those earning up to PKR 600,000 annually will remain unaffected, as the tax rate for this bracket is 0%. While this provides relief, it also means they won’t see any additional financial support to offset living costs.

- Middle-Income Earners: For those earning between PKR 600,001 and PKR 1,200,000, the tax rate jumps to 5%. For example, if you earn PKR 1,000,000, you’ll now pay PKR 20,000 in taxes, up from PKR 12,000.

- Upper-Middle-Income Earners: Those earning between PKR 1,200,001 and PKR 2,400,000 will see their tax rate rise to 10%. A salary of PKR 1,500,000 would now incur PKR 90,000 in taxes compared to PKR 105,000 under the previous rate.

- High-Income Earners: For salaries between PKR 2,400,001 and PKR 3,000,000, the new rate is 15%. If your salary is PKR 2,800,000, you’re now looking at PKR 420,000 in taxes, up from PKR 280,000.

- Top Earners: Those earning more than PKR 5,000,000 annually will face the stiffest increase with a 35% tax rate. For example, a salary of PKR 6,000,000 will incur PKR 2,100,000 in taxes, up from PKR 1,800,000.

In essence, the higher your income, the more you’ll feel the pinch. The steepest hikes impact those in the upper brackets, necessitating a keen eye on their financial planning.

Possible Adjustments and Financial Planning

Given these changes, it’s crucial to adjust your financial planning to cushion the blow. Here are some strategies:

- Budgeting: Tightening your budget becomes necessary. Track your monthly expenses and identify areas where you can cut back. Tools like budgeting apps can help you manage your finances better.

- Savings: Prioritize saving. Set aside a portion of your income each month into a savings account or an emergency fund. This helps you prepare for unexpected expenses and financial downturns.

- Investments: Diversify your investment portfolio. Consider low-risk investments like bonds or high-yield savings accounts. Real estate and stocks can also be viable options, but always consult with a financial advisor.

- Tax Deductions: Look for legal tax deductions and credits you qualify for. Expenses related to education, healthcare, and charitable donations can sometimes be deducted, reducing your taxable income.

- Retirement Planning: Contribute to retirement plans or pension funds. Not only do they secure your future, but they can also offer tax benefits.

- Financial Advice: Consult a financial planner. Professional advice can help you navigate complex tax rules and find strategies to maximize your after-tax income.

By following these tips, you can better manage your finances and mitigate the impact of the new tax rates. Staying proactive with your financial planning will ease the transition and help you maintain a stable financial outlook.

Public and Expert Reactions

The proposed tax changes in the 2024-25 budget have sparked a range of reactions from both the public and financial experts. This section dives into the sentiments and analyses surrounding the new tax rates.

Public Opinion

The general public’s reaction to the new tax rates has been mixed. Some people are expressing their frustration, while others see it as a necessary change for the country’s economic future. In social media forums and public gatherings, a few key themes have emerged:

- Protests: Many citizens, especially those in the higher income brackets, are concerned about the significant increase in their tax liabilities. Some have taken to the streets in protest, arguing that this move will strain their finances and reduce their disposable income.

- Support: On the flip side, there are groups that support the government’s decision. They believe that higher taxes on the wealthy can help reduce income inequality and fund essential public services like healthcare and education.

- Confusion: There’s also a lot of confusion and concern about how these changes will be implemented. People are looking for clarifications on how the new tax brackets will affect their monthly incomes and are eagerly awaiting detailed guidance from the government.

Many citizens are weighing the trade-offs between personal financial strain and the potential benefits to society. The public mood is a blend of anxiety, apprehension, and cautious optimism.

Expert Analysis

Financial experts have been quick to offer their insights on the long-term effects of the new tax rates. Their analyses provide valuable context and predictions for both the population and the economy:

- Economic Stability: Experts agree that the increased taxes could help stabilize Pakistan’s economy by improving government revenues. This additional income can be funneled into vital public sectors, potentially leading to better services and infrastructure.

- Investment Concerns: On the downside, there are worries about how these tax changes could impact investment. Higher taxes may discourage both local and foreign investors, potentially slowing economic growth. Experts warn that the government needs to balance tax increases with policies that attract investments.

- Inflation Impact: Some analysts predict that higher taxes on the salaried class may lead to reduced consumer spending. This could affect businesses, leading to slower economic activity and possibly higher inflation rates. The government will need to monitor these factors closely to avoid economic stagnation.

- Income Inequality: Many economists praise the progressive nature of the new tax brackets. By taxing higher incomes at steeper rates, the government aims to reduce income inequality. This is seen as a positive step towards a fairer economic system.

To sum it up, experts highlight that while the new tax rates can provide essential revenue and promote equity, they come with risks that need careful management. Balancing revenue generation with economic growth is key for the success of this budget.

Stay tuned as we further break down the implications of the 2024-25 budget, offering more insights into how these changes will unfold.

Government’s Response to Criticism

With the announcement of the new tax rates in the Budget 2024-25, the government has faced a wave of criticism from various quarters. Here’s how they’ve responded.

Official Statements

Government representatives have been quick to defend the new tax policies. They have issued statements aimed at reassuring the public and explaining the rationale behind the changes. Finance Minister Ayesha Khan stated, “The increased income tax is necessary to generate substantial revenue. This will ensure better public services and infrastructure.”

Another official, Economic Adviser Ahmad Raza, emphasized, “The new tax structure is designed to be progressive. Those who earn more will contribute more. This will lead to a fairer distribution of wealth.”

These statements underline the government’s stance that higher taxes are essential for economic stability and social equity. The officials insist that these measures are in the nation’s best interest and will ultimately benefit all citizens.

Policy Adjustments or Clarifications

In response to the backlash, the government has made some adjustments and provided further clarifications to address public and expert concerns.

- Adjusted Tax Brackets:

- The government has slightly modified the income ranges for certain tax brackets. For example, the lower limit for the 35% tax rate has been adjusted from PKR 5,000,000 to PKR 5,200,000, offering slight relief to some high earners.

- Clarification on Implementation:

- Detailed guidelines on how the new tax brackets will be applied have been released. This includes comprehensive FAQs and examples to help employees understand how their monthly income will be affected.

- Potential Exemptions:

- The government has hinted at potential exemptions for specific sectors, such as healthcare and education professionals. This aims to avoid undue financial strain on those providing essential services.

- Revised Tax Reliefs:

- Additional tax relief options have been introduced for low and middle-income earners. This includes increased deductions for education and healthcare expenses.

These adjustments and clarifications aim to ease concerns and demonstrate that the government is listening to the feedback. While the core tax increases remain, these modifications reflect an attempt to make the transition smoother and fairer for all.

Stay with us as we continue to dissect the Budget 2024-25 and what it means for you. Understanding these nuances will help you navigate the new financial landscape with confidence.

Conclusion

The proposed income tax changes in Pakistan’s Budget 2024-25 could impact salaried individuals significantly. The new tax brackets mean higher rates, especially for those with substantial incomes. These changes aim to increase state revenue, promote economic stability, and foster equity.

For the salaried class, this means tighter budgets and careful financial planning. It’s essential to understand the new rates and adjust accordingly. Prioritize saving, redefine budgets, and explore tax deductions and investment opportunities to mitigate the effects.

While this shift aims for broader economic benefits, it places a heavier burden on earners. Stay proactive in managing your finances to navigate this challenging landscape successfully.