It’s no secret that people with disabilities are underrepresented in the workforce. Despite making up a significant portion of the global population, the employment rate for individuals with disabilities lags far behind that of their non-disabled counterparts. This gap isn’t just a statistical concern; it has profound impacts on the lives and livelihoods of millions.

Continue reading “Why Are People with Disabilities Underrepresented in the Workforce? “Category: Health

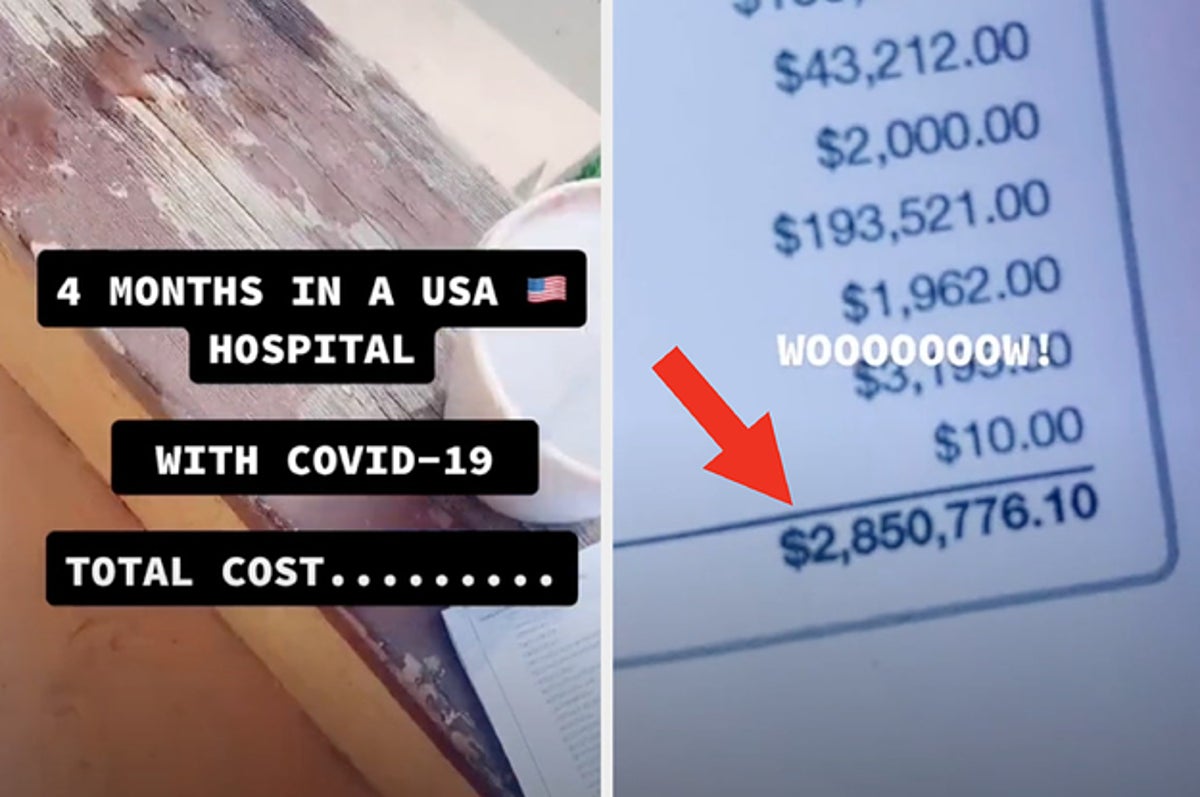

Are Americans Really Forced to Pay Outrageous Hospital Bills?

Are Americans really expected to pay outrageous hospital bills? Unfortunately, yes. Despite having some of the best medical facilities in the world, the U.S. also has some of the most expensive healthcare. A recent sweeping change proposed by the Biden administration aims to ease the burden by banning medical debt from affecting credit scores, but the problem remains significant.

Millions of Americans are drowning in medical debt, driven by high costs, surprise billing, and inadequate insurance coverage. This issue affects everyone, regardless of their insurance status. Even simple procedures can lead to staggering bills, leaving many questioning the sustainability of the current system. This blog post will explore why medical costs are so high and what recent developments mean for the future of American healthcare.

The Reality of Hospital Bills in America

American hospital bills are notorious for being extremely high. Whether you have insurance or not, hospital bills can quickly spiral out of control. From emergency room visits to routine surgeries, the costs can leave many Americans in dire financial situations. In this section, we dive into some eye-opening statistics and share real-life stories to illustrate the harsh reality of medical debt in America.

Statistics on Medical Debt

Recent data reveals the staggering extent of medical debt in the United States:

- Approximately 100 million Americans are burdened with medical debt.

- Nearly 20% of Americans have medical debt in collections.

- Among working-age adults, 27% face medical debt totaling more than $500, with 15% having debt exceeding $2,000.

Despite over 90% of Americans having some form of health insurance, medical debt remains pervasive. The Kaiser Family Foundation estimates that people in the United States collectively owe at least $220 billion in medical debt.

Additionally, the Consumer Financial Protection Bureau found that around 15 million Americans had medical bills on their credit reports as of June 2023. While this is a significant decrease from previous years, it still highlights a critical financial burden for many.

Photo by John Guccione www.advergroup.com

Photo by John Guccione www.advergroup.com

Real-Life Examples

Understanding the human impact of medical debt illuminates just how dire the situation can be. Here are some stories that show the stark reality of high hospital bills:

- The Johnson Family: After their son, Liam, was diagnosed with a rare illness, the Johnson family faced over $200,000 in medical bills. Despite having insurance, they were left with an immense out-of-pocket cost that led them to remortgage their home.

- Maria Lopez: Maria, a single mother, had to undergo emergency surgery that resulted in $50,000 of debt. With a modest income, she found herself choosing between paying for medical bills and basic necessities. Her story is a harsh reminder of how medical emergencies can devastate financial stability.

- David Owens: David, a young professional, sustained an injury that required extensive physical therapy. The costs accumulated to $30,000, far beyond what his insurance covered. Struggling to pay the bills, he took on multiple jobs and delayed pursuing his master’s degree.

For more stories and a deeper understanding of the impact of medical debt on Americans, you can read this NPR article.

The personal stories of individuals like the Johnsons, Maria, and David bring a human face to the crisis of medical debt in America. These narratives are not isolated; they represent a broader trend affecting millions across the country.

Conclusion

Medical debt is more than just statistics; it’s about real people struggling to make ends meet. The high cost of healthcare forces many Americans into difficult choices, affecting their financial well-being and overall quality of life.

Factors Contributing to High Hospital Bills

Hospital bills in America are shockingly high for several reasons. These factors combine to create a situation where even routine medical care can become a financial burden for many. Let’s explore the main contributors to these overwhelming costs.

Lack of Price Transparency

One major issue is the lack of price transparency in healthcare. Patients often have no idea what a procedure will cost until they receive the bill. This can lead to unexpected and often exorbitant charges.

Imagine going to a restaurant and not knowing the price of a meal until after you’ve eaten. This is what it feels like for many patients when they seek medical care. The prices for the same procedure can vary widely between hospitals, and without transparency, patients can’t shop around for the best price.

For more insights on the limitations and necessity of price transparency in American healthcare, check out this AMA Journal article.

Photo by Engin Akyurt

Photo by Engin Akyurt

Insurance Issues

Insurance policies also play a significant role. While insurance is supposed to help reduce out-of-pocket costs, various issues with insurance contribute to high hospital bills.

- Underinsurance: Many people have insurance plans that don’t cover enough of their medical expenses. This is called being underinsured. When major medical issues arise, underinsured patients still face high out-of-pocket costs.

- Surprise Billing: Another big problem is surprise billing. This happens when patients receive care from out-of-network providers without realizing it, leading to unexpected high charges.

To understand your rights against surprise medical bills, you can visit this CMS fact sheet.

Administrative Costs

Administrative costs significantly contribute to the overall expense of healthcare. These are the costs associated with billing, coding, and managing insurance claims.

Administrative costs make up a staggering 15% to 30% of healthcare spending in the U.S.

Here are some key points about administrative expenses:

- Billing and Insurance: Handling complex billing and insurance processes require many resources.

- Regulatory Compliance: Hospitals must comply with numerous regulations, which also adds to administrative burdens.

The high administrative costs are highlighted in this Health Affairs article.

Understanding these factors helps shine a light on why hospital bills are so high in America. While each factor alone is significant, together they create a perfect storm of skyrocketing costs.

Comparing U.S. Healthcare Costs to Other Countries

Healthcare costs in the U.S. are among the highest in the world. Many wonder why Americans pay so much more for healthcare compared to other developed nations. Let’s examine why costs are higher in the U.S. and the outcomes of these high costs on the population.

Why Are Costs Higher in the U.S.?

Several factors contribute to the high cost of healthcare in the United States:

- Administrative Costs: The U.S. healthcare system has complex administrative processes that include billing, coding, and insurance claims management. These processes significantly drive up costs. In fact, administrative costs can account for nearly 15% to 30% of total healthcare spending.

- Drug Prices: Prescription drug prices in the U.S. are significantly higher than in other countries. The lack of price regulation allows pharmaceutical companies to set prices much higher than in nations with government-negotiated drug prices.

- Physician Salaries: American doctors generally earn higher salaries compared to their counterparts in other countries. While this reflects the high level of training and expertise, it also raises overall healthcare spending.

- Hospital Services: The cost of hospital services, including surgeries and outpatient care, is inflated due to high labor costs, technology usage, and administrative expenses.

- Price of Medical Services: Prices for medical services, including imaging and diagnostic tests, are higher in the U.S. due to multiple factors, including the use of advanced technology and specialists.

For a deeper dive into the factors driving high U.S. healthcare spending, you can read more from Health System Tracker.

Outcomes of High Healthcare Costs

High healthcare costs have several far-reaching impacts on the American population. Let’s explore some of these consequences:

- Financial Burden: The high cost of medical care puts a significant financial burden on individuals and families. Many people struggle with medical debt, which can lead to severe financial stress and even bankruptcy.

- Access to Care: High costs can prevent individuals from seeking necessary medical care. This can lead to worsening health conditions and higher costs in the long run. In some cases, people skip tests, treatments, or medications because they cannot afford them.

- Health Disparities: The high cost of healthcare exacerbates health disparities. People with lower incomes or inadequate insurance are disproportionately affected, often receiving lower quality care or delaying necessary treatment.

- Economic Impact: The economic impact of high healthcare costs is felt across the country. Businesses face higher insurance premiums for employees, and individuals may have less disposable income to spend on other goods and services, which can affect overall economic growth.

To understand more about the challenges Americans face with healthcare costs, you can read this Kaiser Family Foundation article.

Photo by Pixabay

Photo by Pixabay

These outcomes highlight the urgent need for reform in the U.S. healthcare system to make it more affordable and accessible for all.

Policy Responses and Reforms

Amid the ongoing crisis of high hospital bills in the United States, government initiatives and state-level reforms are key strategies aiming to alleviate the burden. These efforts are crucial in ensuring that Americans do not fall into financial ruin due to medical expenses.

Government Initiatives

The Biden administration has taken significant steps to address the issue of medical debt. One such initiative is the proposal to ban medical debt from credit reports. This move aims to shield millions of Americans from the negative impact of medical debt on their credit scores.

Photo by Funkcinės Terapijos Centras

Photo by Funkcinės Terapijos Centras

Under this proposal, medical debt would no longer be included in credit reports, providing relief to over 15 million Americans. The removal of medical debt from credit histories is expected to improve credit scores for many, offering a better chance at financial stability. More details on this initiative can be found in CBS News and ABC News.

State-Level Reforms

While the federal government plays a critical role, states are also stepping up with their own reforms and pilot programs aimed at tackling high medical costs. Several states have introduced innovative measures to control healthcare expenses and provide relief to residents.

Some notable state-level efforts include:

- Enhanced Price Transparency: States like Colorado and Oregon are pioneering price transparency laws that require hospitals to disclose the costs of procedures upfront. This allows patients to make informed decisions and potentially choose more affordable options.

- Public Option Plans: States such as Washington and Nevada are implementing public option healthcare plans, which aim to provide more affordable alternatives to private insurance. These plans often come with lower premiums and broader coverage.

- Prescription Drug Cost Regulation: States including Maryland and California have enacted laws to regulate prescription drug prices. These measures seek to cap the costs of essential medications, making them more accessible to the public.

A comprehensive review of various state strategies to reduce healthcare spending can be found in this Commonwealth Fund report and the National Conference of State Legislatures.

These state-level reforms represent important strides toward making healthcare more affordable and equitable. By tackling different aspects of the healthcare system, from pricing transparency to drug costs, states are creating a more manageable environment for their residents.

What Can Individuals Do?

Managing and reducing hospital bills can feel overwhelming, but there are ways to make those bills more manageable. Here are two key strategies: negotiating bills and seeking financial assistance.

Photo by Engin Akyurt

Photo by Engin Akyurt

Negotiating Bills

Negotiating medical bills can lead to significant savings. It might seem daunting, but with the right approach, you can reduce what you owe.

Tips for Negotiating Medical Bills:

- Review Your Bill Thoroughly: Before negotiating, carefully review your bill for any errors. Sometimes charges are duplicated or items you didn’t receive are listed.

- Request an Itemized Bill: Ask for an itemized bill so you can see the exact charges. This can help you identify mistakes or areas where costs seem unusually high.

- Research Fair Prices: Use resources like Healthcare Bluebook to understand what fair prices are for the procedures or treatments you received.

- Contact the Billing Department: Once prepared, call the hospital’s billing department. Explain your situation and ask if there are any available discounts or payment plans.

- Negotiate Directly with Providers: Providers may offer discounts for prompt payments or negotiations for cash payments.

- Get Help from an Advocate: Sometimes a professional can negotiate for you. Services like Health Advocate specialize in medical bill negotiation.

For more detailed guidance, the Washington Post offers additional tips on negotiating your medical bills effectively.

Seeking Financial Assistance

If negotiating your bill isn’t enough, there are several financial assistance programs available that can provide relief.

Options for Financial Assistance:

- Charity Care Programs: Many hospitals offer charity care programs that provide free or reduced-cost care to patients who meet certain income criteria. Check with your hospital’s billing department to see if you qualify.

- Medical Bill Advocacy Services: These services can help navigate the complexities of medical billing and insurance claims. They work on your behalf to reduce your bills.

- Nonprofit Organizations: Nonprofits like The HealthWell Foundation and Patient Advocate Foundation offer grants and assistance for medical bills.

- Government Programs: Programs such as Medicaid, Medicare, and others provide financial assistance for medical expenses. Visit the CMS website to learn more about eligibility and application procedures.

- Ask Your Insurance Provider: Sometimes, insurance providers have programs to assist with unexpected medical expenses. It’s worth calling to ask about any available assistance or payment plans.

For a broad overview of financial assistance options, you can explore this detailed guide by the Consumer Financial Protection Bureau.

These strategies can significantly reduce the financial burden of medical costs. By being proactive and utilizing available resources, you can manage your hospital bills more effectively.

Stay tuned for more sections that will help you navigate the complex landscape of medical debt in America.

Conclusion

High hospital bills place an enormous burden on Americans. These costs harm financial stability, force tough choices, and create lingering debt. The factors driving these costs are numerous, but the impact is clear and severe.

Addressing this issue is crucial. Stay informed and push for meaningful policy changes.

By understanding the scope and causes of high medical costs, we can demand a system that prioritizes care over profit.